The insurance brokerage business is evolving in an environment that is increasingly regulated by the regulatory authorities, first and foremost theACPR, which ensures the financial soundness and transparency of players in the sector. Against this backdrop, regulatory compliance requirements have never been higher.

Regulatory reporting: a challenge, but also an opportunity for insurance brokers!

For insurers, this means providing regulators with structured, reliable and up-to-date reports on the company’s activities, accounting data, risks, equity capital and environmental commitments.

For insurance brokers, this includes transparency obligations towards customers, financial transparency, compliance with anti-money laundering and anti-terrorist financing rules, and reporting on tax regulations.

The main reports expected :

Financial reporting

As an insurer, you must provide regular financial statements to the ACPR to demonstrate your solvency and financial health. These reports include:

- Detailed balance sheets.

- Income statements.

- Information on shareholders’ equity.

Prudential reporting

You are required to provide information on your risk management. This includes the policies in place to guarantee the security of insured assets, as well as internal control mechanisms.

👉 The ACPR provides standardized formats that brokers must follow. These formats include risk indicators and specific control measures(https://acpr.banque-france.fr/fr/professionnels/lacpr-vous-accompagne/assurance/faire-mes-reportings-assurance).

Reporting on the fight against money laundering and terrorist financing

You must also comply with anti-money laundering (AML) and anti-terrorist financing (FT) obligations. This means:

- Transmission of suspicious transaction reports to TRACFIN.

- Setting up customer verification processes (KYC).

👉 TRACFIN reports must follow a precise format, with full details of suspicious transactions, customer profiles and action taken.

👉 You can also refer to the guides and recommendations available on the ACPR website.

Failure to comply with reporting requirements or other legal obligations can result in sanctions ranging from a simple warning to withdrawal of authorization (substantial administrative fines, suspension or withdrawal of authorization, legal proceedings in the case of serious breaches).

Want to modernize your practice? Ask for an ADHOC demonstration on custy.com.

The major challenges facing regulatory reporting today

Despite their good intentions, brokers face a number of major compliance issues when producing their reports.

Data and source errors

- Multiplication of obsolete Excel files, scattered between departments

- Missing or erroneous data in customer and accounting databases

- Lack of consistent consolidation between financial and contractual data sets

- Manual data entry without security or traceability

🧩 A concrete example: if you record commissions in a separate file from the accounts, you can pass on to the ACPR an unjustified discrepancy, perceived as an anomaly during an internal audit.

Complex and constantly evolving standards

- Multi-faceted regulations: DDA, LCB-FT, RGPD, Solvency II, PRIIPs…

- Frameworks vary depending on the type of product (auto, health, loan, etc.).

- Constant regulatory watch to keep abreast of developments at ACPR, AMF and European level (EIOPA, DDA…).

A lack of suitable tools

- Poor traceability of data processing

- In-house solutions developed by hand, not maintained

- Business systems not designed for regulatory reporting

- Inability to quickly extract the financial data required by the ACPR

What tools are needed to automate and secure regulatory reporting?

Key figures:

– According to an ORIAS report, over 40% of brokers still use manual office tools to consolidate their annual reports,

– Over 20% of inspections carried out in 2023 revealed shortcomings in the maintenance of customer data and contractual documents, according to an ACPR memo.

Faced with these challenges, you need specialized tools to make your reporting process more reliable and automated.

Reporting software: centralization and integrated compliance

- Automatic integration of financial, customer, product and commission data

- Generation of reports in compliance with ACPR standards

- Synchronization with regulatory updates (ORIAS, LCB-FT, compensation transparency)

- Pre-configured reports (ledgers, certificates, ESG indicators)

Data governance and automated quality control

- Defining a data governance framework: who modifies what, when, how

- Integrated quality control engine: detects discrepancies or input errors

- Secure, time-stamped data archiving forinternal audit purposes

- Ensuring consistency between customer, commission, product data and contractual documents

Dashboards, auditability and paperless reporting

- Synthetic dashboards with alerts on key regulatory compliance indicators

- Automatic export in expected formats (Excel, PDF, XBRL) for transmission to ACPR or ORIAS

- History of changes retained for internal controls and inspections

- Dematerialization of reports and electronic signature of compliance documents

Best practices for effective regulatory reporting

Tools are essential, but effective reporting also requires proven methods.

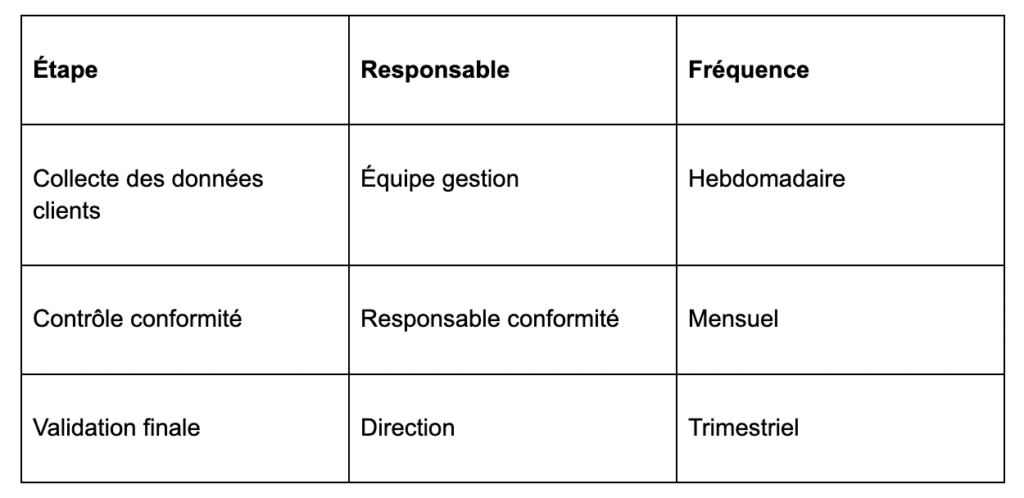

Structure collection and validation processes

- Define a clear workflow for collection, validation and distribution

- Make every player accountable: management, finance, compliance, senior management

- Document reporting procedures and deadlines

Role tracking table

Train teams and build a culture of compliance

- Provide ongoing training for teams on the latest regulatory developments

- Integrate a culture of compliance right from the start

- Organize awareness-raising sessions on regulatory risks and the costs of non-compliance

Implement internal controls and regular audits

- Automate report checkpoints

- Carry out regular cross-team reviews (ORIAS, KYC, compensation)

- Prepare internal audits with a centralized, time-stamped audit trail

Towards more complex reporting

Regulatory reporting in the insurance brokerage sector is no longer limited to traditional financial data. Under the impetus of regulatory authorities such as the ACPR, it is expanding to include extra-financial dimensions: ESG (Environmental, Social and Governance) criteria, green taxation, risk governance… These developments reflect a desire to align finance with the challenges of sustainability and transparency, including for brokers.

ESG and extra-financial reporting

- New climate and CSR obligations

Although brokers are not yet directly subject to the CSRD directive, they are increasingly called upon to demonstrate their commitment to social responsibility. This includes environmental impact, ethical management and professional equality. - Progressive integration into reporting software

Many software publishers are now adding ESG modules to their reporting software, facilitating the collection, structuring and monitoring of extra-financial data. - Growing expectations from partners

Insurance companies, often subject to ESG obligations, expect greater transparency from their intermediary partners (including brokers). Being able to produce reliable ESG reporting is becoming a competitive advantage.

Integrate the new expectations of regulators

- Anticipate upcoming regulations: CSRD, Green Taxonomy…

Although not all of these regulations are yet applicable to brokers, it’s a good idea to start preparing now, especially for those who are part of a group or are experiencing strong growth. - Adapt your tools

Your reporting systems must be able to integrate these new dimensions: ESG indicators, specific tax data, documentation on risk governance, etc. - Work cross-functionally

Non-financial reporting involves several functions: compliance, legal, finance, human resources… Clear coordination and solid data governance are essential.

Use reporting as a decision-making tool

✔️Rely on reliable, auditable data

Quality data is essential to avoid regulatory risks, secure financial reporting and support yourcontinuous improvement strategy.

✔️ Identify levers for improvement

By analyzing your data sets, you can detect gaps, track your progress, improve your processes and reinforce your culture of compliance.

✔️ Make reporting a strategic lever

Well-structured reporting, aligned with compliance standards, becomes a decision-making tool for management and strengthens your credibility with partners, customers and authorities.

In 2025, ESG (Environmental, Social, Governance) reporting is not a direct legal obligation for most insurance brokerage companies, especially small and medium-sized independent firms that are not listed or subsidiaries of financial groups.

⚠️…But it can become so indirectly

- If you are a subsidiary of a group subject to the CSRD directive, you may be asked to submit ESG data.

- Some insurers and institutional partners are beginning to ask for CSR commitments or ESG indicators in their business relationships.

- Green taxonomy and European value chain requirements could broaden obligations in the future.

Conclusion: invest in the right regulatory reporting tools

According to a Deloitte study, almost 30% of errors in regulatory reporting are due to a lack of suitable tools or manual processes.

By equipping yourself with the right software and structuring your processes, you can turn compliance into a real competitive advantage.

Regulatory reporting should no longer be a constraint, but a strategic lever for your brokerage firm. Your financial transparency, credibility with insurance partners and ability to anticipate regulatory risks all depend on it.

With the right tools, you can :

- Centralize your data and make your reports more reliable

- Drastically reduce error rates

- Anticipating ACPR audits and inspections

- Manage your day-to-day compliance with agility

👉 Things to remember :

- Regulatory reporting is a strategic lever for corporate transparency and credibility.

- Dedicated tools centralize data, automate checks and reduce errors.

- Failure to comply with regulatory requirements can result in heavy financial and reputational penalties.

- In addition to IT tools, we need to implement best practices and train our teams.

The regulatory compliance obligations imposed on insurance brokers by the ACPR continue to intensify. But far from being a constraint, regulatory reporting can become a lever for financial transparency and professionalization.

Brokers equipped with dedicated reporting software, coupled with rigorous data governance and ongoing team training, minimize their risks while enhancing their image with insurers and customers alike.

The Adhoc solution to meet regulatory reporting requirements

With ADHOC, you can turn this obligation into a competitive advantage: time savings, better organization, increased confidence from partners and insurers.

ADHOC, a management software package 100% dedicated to insurance brokers, enables you to integrate regulatory requirements into your day-to-day business without complicating it.

Advantages:

- Centralization of all customer and contract data

- History of vigilance actions retained

- Automatic alerts for non-compliant files

- Interconnection with official databases (PPE register, asset freeze, etc.)

- Automatic generation of reports (LCB-FT, PPE vigilance, etc.)

- Secure archiving of supporting documents and audit logs

- Automatic regulatory updates

Use case: how ADHOC simplifies day-to-day regulatory compliance

Let’s take the concrete example of a general brokerage firm based in the Paris region. Faced with an ever-increasing number of regulatory requirements, this firm was faced with several major challenges:

- LCB-FT vigilance was difficult to centralize: customer information was scattered across several tools, making controls tedious and time-consuming.

- Manual management of verifications, particularly for Politically Exposed Persons (PEPs) or asset freeze obligations, increasing the risk of errors.

- Painstaking preparation for internal audits or ACPR inspections, with data that is not historically recorded and difficult to use.

Setting up ADHOC: a rapid, structuring transformation

After choosing ADHOC, the management software developed by Custy, the firm was able to restructure its compliance processes in depth. In just a few weeks :

- The entire customer journey has been digitized, from the initial collection of documents to the final validation of the file. This gave us a clear, instant overview of every stage in the customer lifecycle.

- Automatic alerts have been set up to flag sensitive profiles (PEPs, unidentified beneficial owners, potential asset freezes), thus limiting the risk of non-compliance.

- API connections with official databases (Treasury register, INPI, OFAC lists) have been activated to automate regulatory checks.

- During internal audits, standardized reports were generated in just a few clicks, including action histories, supporting documents and audit logs.

Testimonial

“Before ADHOC, compliance was a constant burden, experienced as administrative pressure. Today, we’ve gained peace of mind: in the event of an audit, everything is traced, logged and documented. We can demonstrate our compliance at any time, without having to put in a full day’s work.

– Firm manager, Île-de-France

Thanks to ADHOC, compliance has gone from a burden to a competitive advantage. The team can now concentrate on its core business: consulting, customer relations and business development, while remaining fully compliant.

👉 Don’t wait for the next audit to take action: adopt secure, integrated compliance management.