Insurance artificial intelligence is no longer a futuristic technology reserved for large insurance companies. Today, it is an indispensable tool for insurance brokers seeking to optimize their operational efficiency and meet the growing demands of their customers.

In an increasingly competitive market, where customer service responsiveness and service personalization are becoming major differentiating factors, AI for brokers represents a unique opportunity for insurance digital transformation.

In this article, find out how AI tools are gradually being integrated into your day-to-day business: task automation, service personalization, claims management, data analysis, fraud detection…

Why is AI becoming essential for brokers?

The rise of artificial intelligence in the insurance sector is a response to a number of major challenges that you face as a broker on a daily basis: higher customer demands, complex regulations, the need for agility and efficiency.

Ever-higher customer expectations

Policyholders are now waiting :

- Immediate responsiveness, even outside opening hours, thanks to insurance chatbots or virtual assistants.

- Tailor-made services adapted to their situation via service personalization tools.

- A seamless customer experience, with no friction between channels (email, telephone, messaging).

A concrete example: a management tool integrating AI enables :

– answer simple questions thanks to a chatbot available 24/7,

– recommend offers based on customer history analysis,

– prioritize reminders adapted to each profile,

Thecustomer experience is becoming a decisive criterion of choice. A broker able to offer fluid, personalized interaction thanks to virtual assistants and insurance chatbots gains a significant competitive advantage over less digitalized competitors.

Increasing regulatory and administrative pressure

Document management, regulatory compliance, claims tracking and RGPD compliance represent a significant burden, which artificial intelligence can significantly reduce thanks to :

- Automation of document processing tasks (reading, filing, archiving),

- Improve compliance with automated alerts on regulatory deadlines or missing documents, and generate compliance reports in just a few clicks.

- Reducing human error, which can have legal or financial consequences.

- Traceability of advice: Automatic documentation of recommendations and justifications given to customers

This considerably lightens the administrative burden on brokers, while reducing the risk of errors and potential penalties. In an increasingly stringent regulatory environment, AI is becoming an essential management tool.

Case in point: a broker reduced its document processing time by 35% by integrating an automatic language processing (ALP) solution.

AI: a powerful lever for efficiency

Artificial intelligence enables you to gain operational efficiency, with :

- Intelligent alerts for priorities (e.g. high-risk files),

- Predictive analysis to anticipate customer needs or contract renewals (e.g.: automatically identify high-potential customers, prioritize sales reminders according to customer behavior, forecast future departures or coverage needs),

- Increased productivity, by focusing human resources on added value and optimizing the workload of in-house teams.

The practical uses of AI in your everyday life

AI is not just for large companies. Many insurance management software packages already incorporate advanced functionalities:

Automation of administrative and management tasks

Automating administrative tasks represents the most immediate and cost-effective application of AI in your brokerage business.

| Task concerned | Integrated AI function | Detail / profit |

|---|---|---|

| Automated reading and entry of customer documents | OCR + NLP | Automatic data extraction from PDF or photo documents (e.g. pay slips, bank statements, invoices, etc.) Intelligent optical character recognition (OCR) that understands document structure Cross-validation of information and detection of inconsistencies Fast, reliable processing |

| Pre-filling of forms | Generative AI | Automatic completion of insurance questionnaires based on existing customer data. Suggested clauses and coverages adapted to the risk profile Automatic generation of personalized sales proposals Saves time, reduces errors |

| Contract relaunch | Automated workflow + scoring | Improved renewal rate |

| Intelligent email management | Automated workflow + scoring | Automatic classification of incoming messages (quotation requests, claims) Automatic replies to simple requests Extraction of important information and automatic creation of follow-up tasks |

| Automatic assignment of files to the right employee | Automated workflow + scoring | Optimization of team activities. |

Thanks to this automation, employees can concentrate on high value-added actions. The gain in productivity is significant, while reducing the risk of human error.

AI and customer relations: chatbots, live assistants and personalization

AI-enhanced virtual assistants can understand requests, sort them out, and respond appropriately. Examples of real-world applications:

– Smart insurance chatbots:

- Automatic answers to frequently asked questions (schedules, contact details, procedures)

- Automated appointment scheduling with calendar synchronization

- First level of advice for simple requests (change of address, adding a driver)

- Document exchange: A customer requests a certificate: the bot generates it automatically.

- Intelligent escalation to a human advisor when necessary

– Advanced personalized recommendations:

- Analysis of customer history to propose relevant complementary insurance products

- Suggestions for optimizing benefits in line with changing personal circumstances

- Identifying the right moments to offer new products (property purchases, births, weddings)

- Analysis of navigation on your website: AI analyzes the user’s browsing experience and suggests an appropriate offer.

– Intelligent and predictive customer relationship management:

- Automatic scoring of prospects according to their probability of conversion

- Automatic prioritization of reminders according to urgency and potential

- Analysis of weak signals indicating a risk of termination

Case in point: a brokerage firm improved its conversion rate by 22% by integrating an AI assistant into its insurance management software, capable of automatically proposing the most relevant offer.

Fraud detection and risk management

AI becomes a strategic tool for claims management and fraud reduction:

- Behavioral analysis of claims.

- Detection of anomalies in claims declarations (temporal and geographical inconsistencies)

- Analysis of known fraud patterns and comparison with new cases

- Automatic alerts in the event of multiple claims or unusual amounts

- Automatic scoring of files.

- Instant assessment of claim credibility

- Automatic assignment of a risk level to each new customer

- Prioritizing files requiring in-depth expertise

- Automatic scoring of files or claims according to risk criteria

- More reliable risk assessments thanks to multi-source data analysis.

- Early identification of customers with evolving risk profiles

- Premium or guarantee adjustment suggestions based ondata analysis

- Anticipation of potential claims based on behavioral and environmental data

What AI tools for brokers?

No need to develop in-house technology: many insurance management software packages already embed AI to make your day-to-day work easier.

1. Intelligent CRM and management software

At Custy, we develop solutions designed to take advantage of AI, particularly in the analysis of customer data, the prioritization of sales actions, or the creation of intelligent dashboards.

Thanks to this approach, our software offers brokers an infrastructure capable of evolving with their needs, while remaining connected to the best automation and predictive intelligence technologies available.

2. Task automation and reporting platforms

Our solutions centralize your data and automate your repetitive processes:

- Customer data centralization and multi-tool synchronization.

- Automated reports for sales management or compliance monitoring.

- Automatic follow-up of reminders and deadlines

3. Specialized natural language and ESG tools

Automatic language processing andgenerative AI technologies are opening up new possibilities forinnovation in insurance.

- Automatic language processing to analyze incoming emails, classify requests and generate standard responses.

- ESG tools integrating analysis of extra-financial data to advise your customers on their CSR commitments.

The prospects for AI in insurance (and its limits)

AI offers real productivity gains for brokers, but it must be well mastered and used ethically to preserve the quality of your customer relationships.

Keeping human contact at the heart of the relationship

AI must not erase the human link. It supports the broker, but does not replace his or her expertise, empathy or ability to build relationships.

- Active listening remains essential to understanding personal situations;

- Personalized advice cannot be replaced by an algorithm;

- AI doesn’t handle emotions, emergencies or complex cases.

– Delegate without total substitution:

- Use AI for repetitive and administrative tasks, reserve complex consulting for employees

- Maintain the customer’s ability to speak to an advisor at any time

- Train your teams to use AI as an assistant, not a replacement

– Preserve personalized advice:

- Maintain direct contact at sensitive times (serious claims, difficult personal situations)

- Use AI to prepare for interviews, not replace them

- Maintain a consultative approach where human expertise remains central

– Be transparent with customers:

- Clearly communicate when a service is automated

- Explain the benefits of AI for the customer (speed, availability, personalization)

- Guarantee human recourse in the event of dissatisfaction

- The challenge is to find the right balance between automation and proximity. The broker remains a central player in the customer relationship.

Respecting data confidentiality

Data privacy and RGPD compliance are essential in the ethical use of AI.

– Raising awareness of RGPD issues and algorithmic biases:

- Plan ongoing training courses on personal data protection obligations, the ethical issues surrounding artificial intelligence, and clear customer consent.

- Carry out regular audits of algorithms to detect discriminatory bias.

- Document automated decision-making processes for customer transparency.

– Rigorous control of technology suppliers:

- Check the RGPD compliance of the AI solutions used.

- Clearly define data protection responsibilities.

- Prioritize data hosting in Europe.

– Data governance:

- Clearly define data access rights according to user profiles.

- Implement secure backup and recovery processes.

- Ensure full traceability of AI uses of customer data.

| Benefits of AI | Limits to consider | Recommended actions |

|---|---|---|

| Increased operating efficiency | Risk of dehumanization | Training teams in ethical use |

| Service customization | Technical complexity | Simple, intuitive solutions |

| Error reduction | Technological dependence | Maintaining manual back-up processes |

| 24/7 availability | Implementation costs | ROI calculated over 3-5 years |

Conclusion – How to take action?

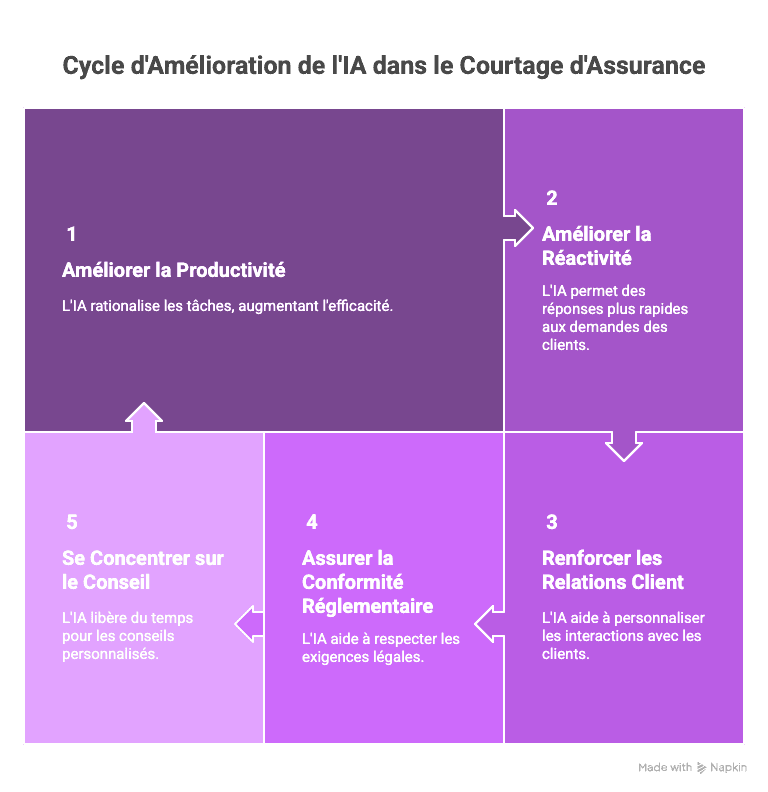

Artificial intelligence is making its way into brokers’ daily tools, becoming a strategic ally in improving productivity, responsiveness, customer relations and regulatory compliance.

Properly managed, AI does not replace the broker: it gives him back his time, reinforces his advisory role and helps him focus on what makes the real value of the business: advice and personalized human support.

Custy software makes this technology accessible, tangible and directly useful in the field. By bringing together automation, intelligent CRM and regulatory compliance, they support brokers in their digital transition without technical complexity.